On the VC private vs. public market arbitrage in crypto

Why is no one buying my coins on Uniswap?

There are a bunch of nuances to understand when it comes to startup fundraising (in crypto or not), the role of venture capital, the competition between VC firms, the value-add investors provide, and the relationship between the public and private markets.

However, it’s clear that in crypto, simply access to private deals has been the largest arbitrage in the market over the past two years.

The arbitrage comes from how the market prices tokens. I wrote about this previously more extensively in my post “Climbing the S-curve of crypto (price) adoption”.

The TLDR; version is that crypto markets have:

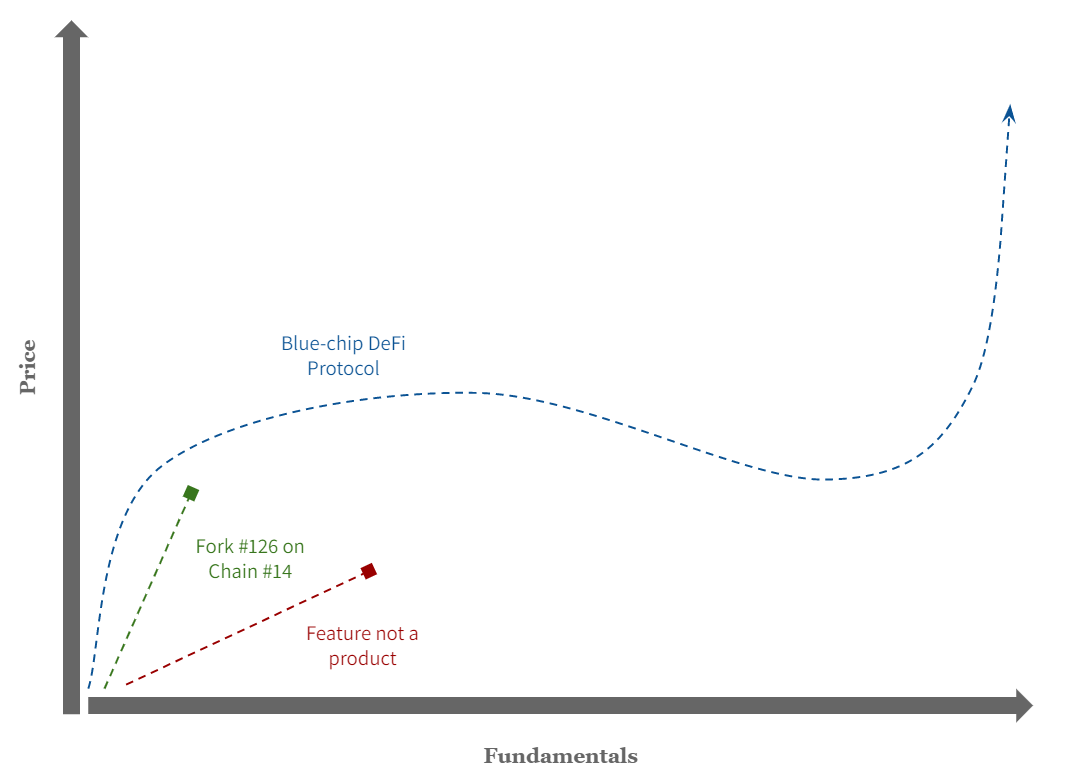

Overrated the price of tokens in relative terms (AMM #4 on Chain #3 is X% of the market leader’s valuation).

Conditioned to look for the next 100x instead of doubling down on “winners”, since it isn’t perceived that runaway winners exist.

This dynamic means that betting on “reasonably good“ startups, early, is the winning strategy. Because crypto projects have a much shorter lifecycle from inception to trading on the public markets compared to traditional companies, there’s liquidity to exit early (subject to some vesting).

By now, it should be clear that the super easy arbitrage here is by-and-large over.

The exit requires retail demand, which doesn’t exist right now. Once you are raising at a $3 billion valuation for a bridge technology (no matter how good), it’s obvious that unhealthy market dynamics are at play and that you are not arbitraging the secondary market.

Good.

The market is supposed to be difficult. Being early shouldn’t be rewarded as much as it has been historically going forward. If the payouts on winners are insane, participation in rounds shouldn’t be a no-brainer.

The best projects choose their investors and extract value from them. It’s also true that regulation will likely make the VC moat larger and punishes retail investors who will have to buy in at valuations where most of the upside is gone.

The math on a16z’s new $4.5 billion fund if $1.5 billion is spent on seed rounds and $3 billion on venture rounds: $50m seed valuation raising $10m with a16z taking 50% of the round on average equals 300 investments.

No way a notable portion of the fund doesn’t find its way to the liquid markets.

The result is that the best VC firms will still outperform the market significantly, but access to deals at cheap valuations to sell to retail investors as a moat is much smaller.

The (perceived but slowly collapsing) preference for private markets over public ones and market dynamics creates an interesting opportunity for public market buyers — at some point.

It is difficult for crypto prices to find support because there’s a lack of structural inflows. Even if the market is dumping there are pension funds etc. that keep buying equities every month. In crypto, there are only a few funds that continuously raise meaningful amounts of capital, and much of that is (mis)allocated to private rounds.

Highly reflexive prices are the result. No one is buying the dip in the public markets and once that turns around funds will change their investment mandate to chase rising prices.

Prediction: funds with $100m or less in AUM (and individual investors) that allocate with the right timing in 5-7 quality winners in the next positive market cycle will outperform almost all funds with a large private market allocation in their portfolio.

This is a fundamentally bullish thesis on crypto because, at some point, we must have clear runaway winners to FOMO into (on the application layer). The market simply can’t go through another cycle without winners emerging that are 100x more valuable than all of their counterparts — and when this is obvious to most market participants.

The caveat is that this is true unless you believe those winners don’t exist yet. Given that we’ve gone an entire market cycle and the same protocols dominate the growth metrics as in 2018 — this seems unlikely.