6 crypto charts that jumped out in the past week

Let's talk about the good and the bad in the markets through some data

i) Lido becoming the #1 protocol by TVL

Lido is now the largest protocol outside of L1s and this gap will widen significantly going forward. The TVL chart will continue to go up only into the merge, and staking derivatives aren’t even close to saturating their market potential.

Staking derivatives are underrated and it’s relatively straightforward to argue they should own 5-10% of the underlying L1 valuations given the control over governance and block production.

LDO remains the “easiest” position to hold for high beta against the broader crypto market.

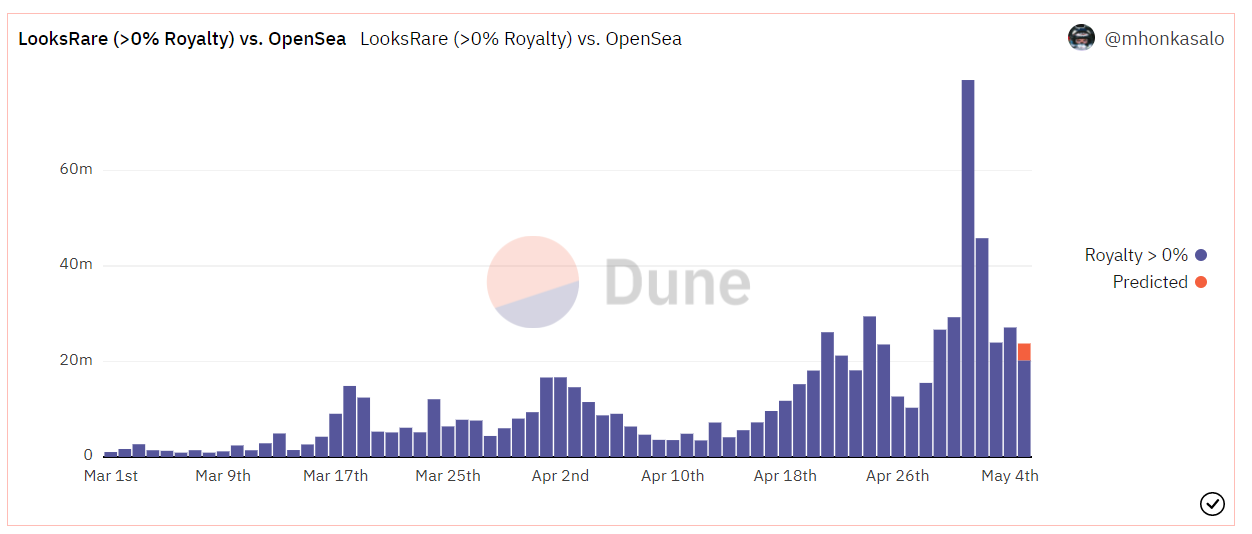

ii) LooksRare vs. OpenSea metrics

This is one I’ve been tweeting about a lot. There’s an argument that it’s in the interest of crypto investors to be bullish about LooksRare (especially vs. OpenSea) simply because it is difficult to get broad NFT exposure in many other ways.

Trade volume is going the the right direction and the current listing rewards that give out LOOKS the closer you are to floor price is intelligently designed. Qualitatively, LooksRare is doing a great job adding new features.

The one metric that was lagging behind and was worrying was the lack of user growth. However, this has trended in the right direction in recent days. If NFTs lose traction and it becomes a power-user game, then user market share will end up on LooksRare.

The market is highly dependent on a few key collections at the moment, and a drop in enthusiasm among them could lead us to a bear market in overall volumes.

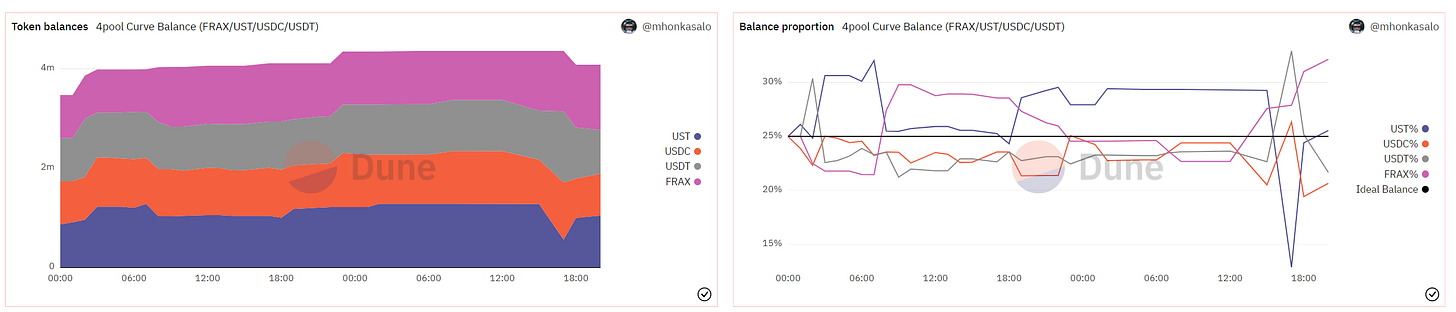

iii) Curve 4pool launch FXS/UST/USDC/USDT

This is a chart that is not interesting at the moment but will be soon.

The Curve 4pool with FRAX, UST, USDC, USDT — and by extension CRV holders — are to an extent subsidizing the UST peg.

How big this pool becomes and how much UST will be in the pool will be interesting to follow, as USDC/USDT becomes a source of exit liquidity.

The success of the 4pool is bad for DAI in the short term, but I believe DAI is better off playing an entirely different game. More on that next week.

Here is the dashboard to follow.

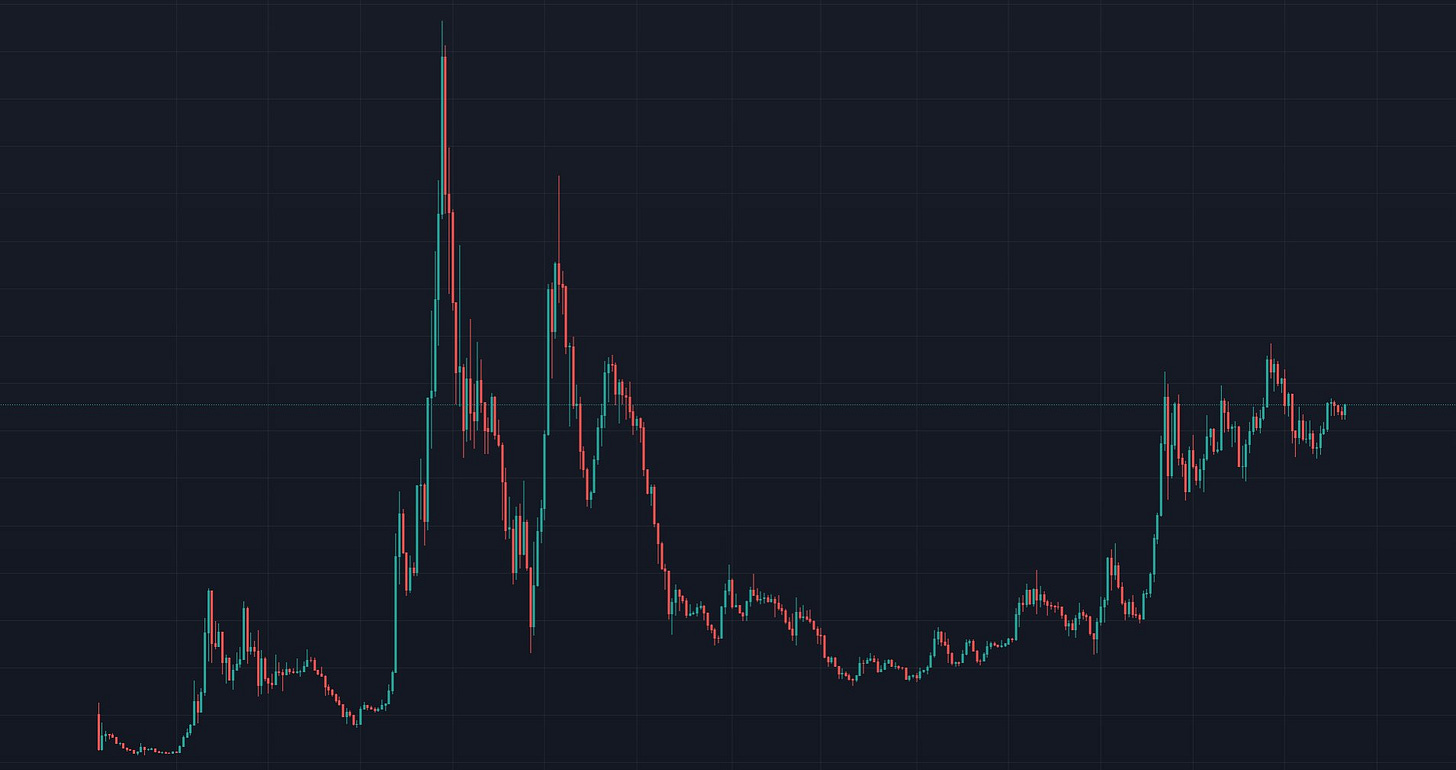

iv) ETH/BTC ascending triangle

Disclaimer: I’m not capable of analyzing charts.

ETH price action vs. BTC over the past few years.

Initial hype.

Depression that only true believers thought we would recover from.

3x pump after BTC ran and the ETH (and “altcoin”) run started.

Consolidation.

It kind of looks like consolidation is ending. A break-up means that we are in the range to immediately start talking about flippening.

Going into the merge, this is a powerful narrative.

v) Solend and Marinade holding the fort for Solana TVL

Solana. In the land of high FDV and low supply, the top 2 projects by TVL don’t have high FDVs.

Solend: $156m FDV.

Marinade $229m FDV.

Qualitatively, both of these projects have done a great job.

Solend is pretty innovative with different parts of their system for a lending protocol — isolated pools and using call options for liquidity mining.

Marinade has managed to fend off attack — with rather impressive incentives — from Lido. Arguably, this makes Lido’s case stronger on the chains it dominates today.

If you believe in the Solana ecosystem at all, I don’t understand how you aren’t buying here. If you don’t, then of course it makes sense not to buy.

vi) Wall Street Journal showing there’s alpha just by not being mislead

The Wall Street Journal article that recently received a lot of hype is a perfect example of correct information struggling to find its way in the modern world and how much you can win by openly observing what is actually happening in the world.

This article claims a 88-92% drop across NFT metrics from September. In reality, aggregate on-chain metrics (users, volume, etc.) show growth of 40-60% in the same time period.

There are a billion people in the comments applauding and sharing this information. Right now, this is the data point the whole world is going off of. Knowing to fade this is alpha.

For what it’s worth, the scenario imagined in the wet dreams of a WSJ writer may actually happen — and that’s when he’d have actual cause to celebrate — I’d remain bullish on the NFT space even then and would buy.

Coming soon: Talk about the MKR surplus buffer and a fundraise to change the protocol’s (perceived) negative direction to a positive one.

Great info. 2 things - could you link me to some consolidated info on Lido and stETH if you have any source? I know it's an alternative to ETH staking for 2.0 or something like that, where you get stETH in return which can be used just like ETH... But I'm not sure why it's supposed to be so good.

Also, the ETHBTC chart has been giving quite a lot of mixed signals recently. This chart could also mean a failed breakout/deviation from range. Unfortunately as of now ETH looks poor vs USD so even going into the merge it could be from "very bottomed" to "not so bottomed" in a few months time.