10 positive (adoption) charts from crypto apps/protocols

I will continue posting up-only charts until morale improves.

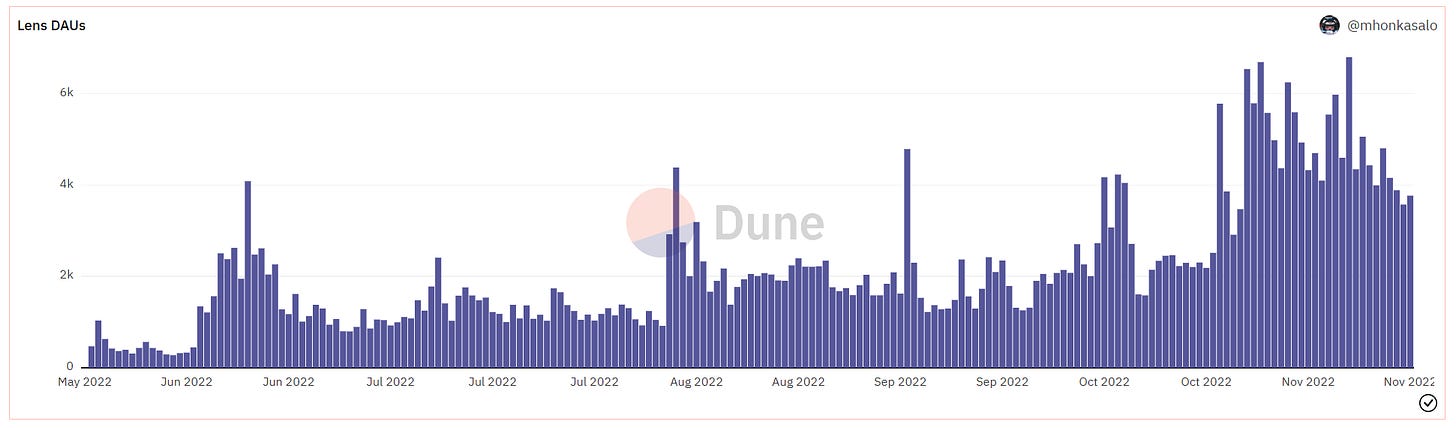

The number of active users and the frequency at which those users interact (even more so) look positive.

According to the site, artists on the platform have made ~$4 million in earnings. The top earners on Spotify are pushing $100 million in total revenue, which relative to the size of the audience is little.

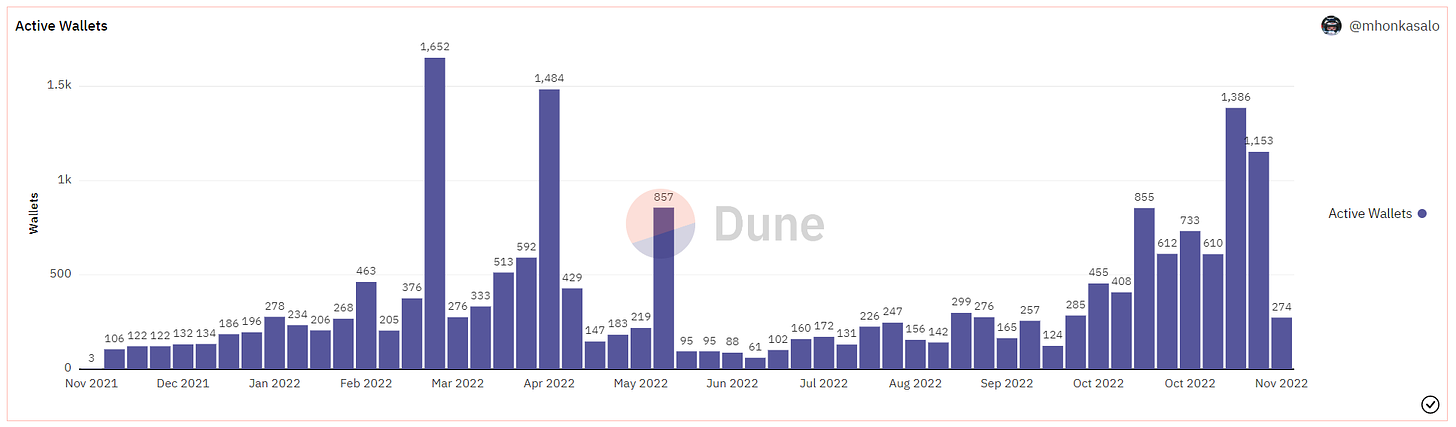

I’ve started posting on Lens Protocol. You can find me at mhonkasalo.lens.

What I really like here is that conceptually, the success of one app really benefits the others since you can port your social graph from one place to another.

Qualitatively, the apps so far are OK and sort of fun to use — honestly was surprised Huddle01 can basically replace simple Google Meets.

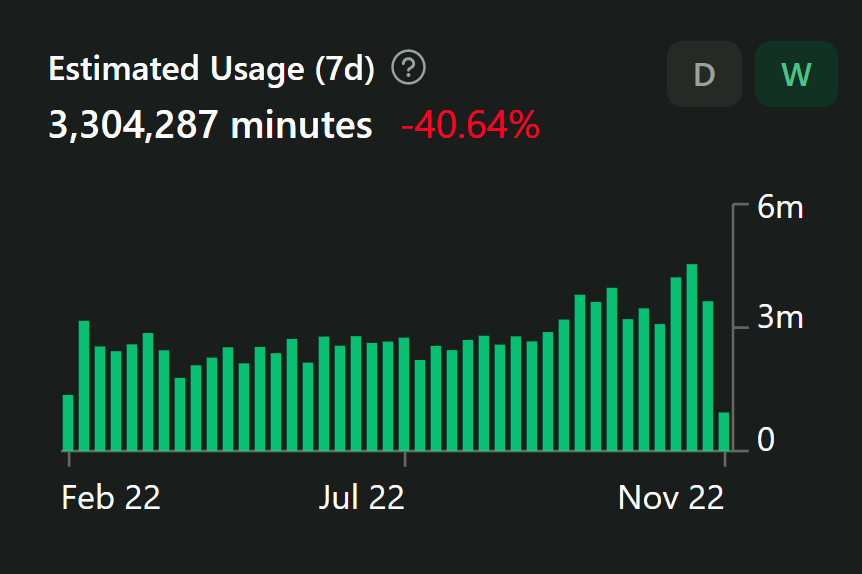

This is a number that has been grinding up slowly, and you’re always wishing for a breakout application. Right now, it seems like minutes are distributed between multiple apps with small amounts of usage.

Livepeer is integrated into Lens Protocol apps. The combination of these 2 protocols both taking off at the same time would get us out of this frustrating internal crypto casino.

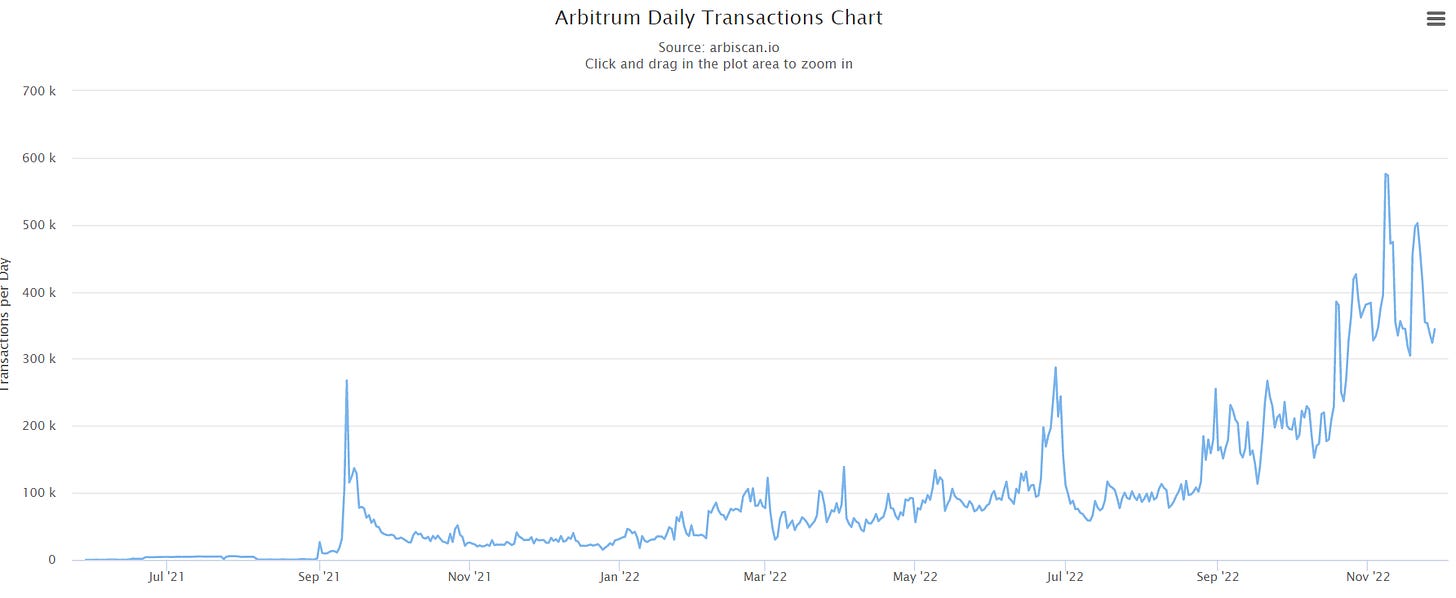

There is some airdrop farming but qualitatively, Arbitrum has done a really solid job in getting high-quality applications onboarded.

Polygon is king today and the market does not care about how “true” L2 implementations are. Ultimately, the technology will converge on similar structures and business development (and incentives) are key.

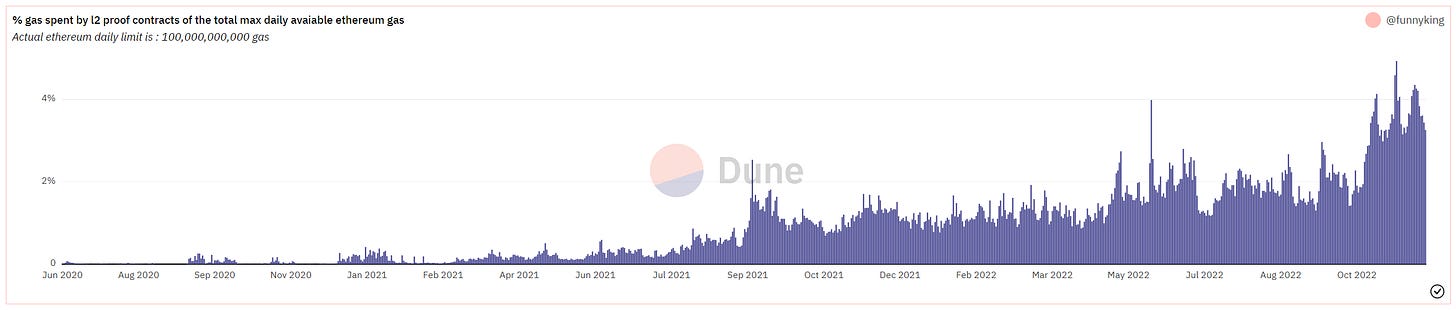

Layer 2s

L2s are now at 4% of total Ethereum gas consumption.

If I had to make a prediction, if we ever hit a bull market again this will be ~25% and gas fees (and thus burn) will still be high on L1. This is because the blockspace between the layers is not entirely fungible.

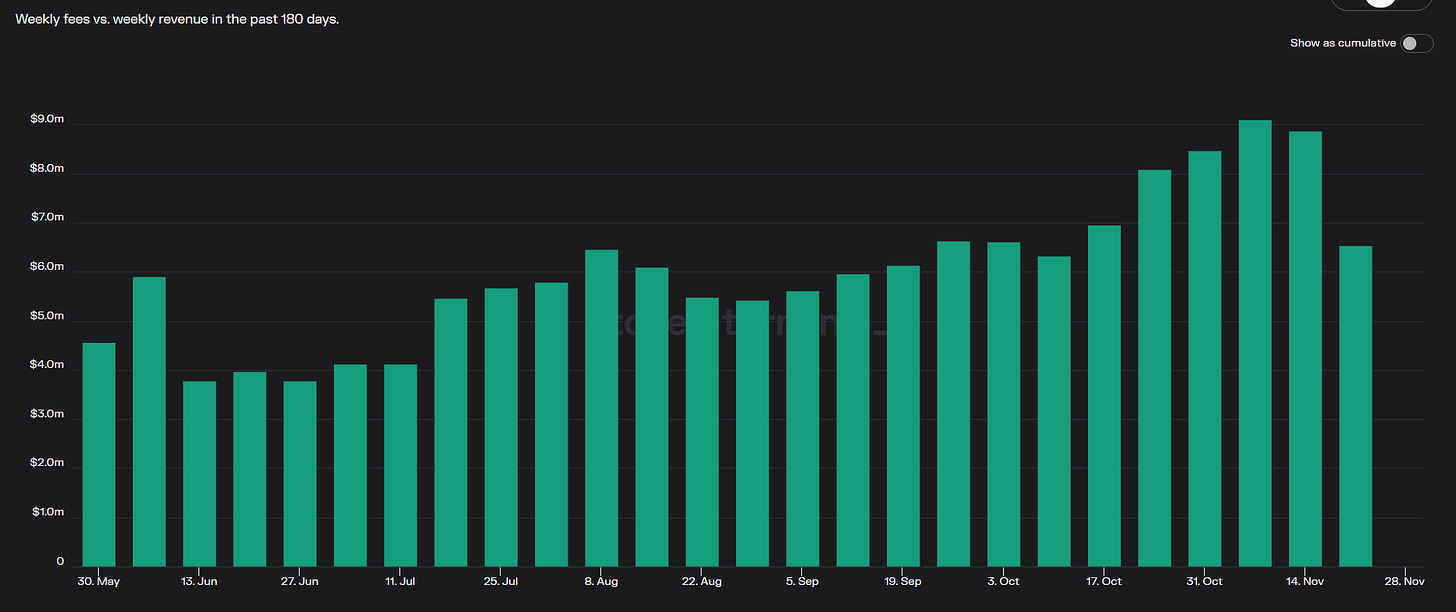

This is slightly cheating since Lido revenue (in ETH terms) can’t actually go down much due to no redemptions. However, it’s worth noting that this is a money-printing protocol with strong network effects.

Valuation here should arguably be quite a bit higher. As it turns out, no one buys crypto based on fundamentals. If there was a protocol that could turn treasury revenue into some token-go-up mechanics, the resources are available here.

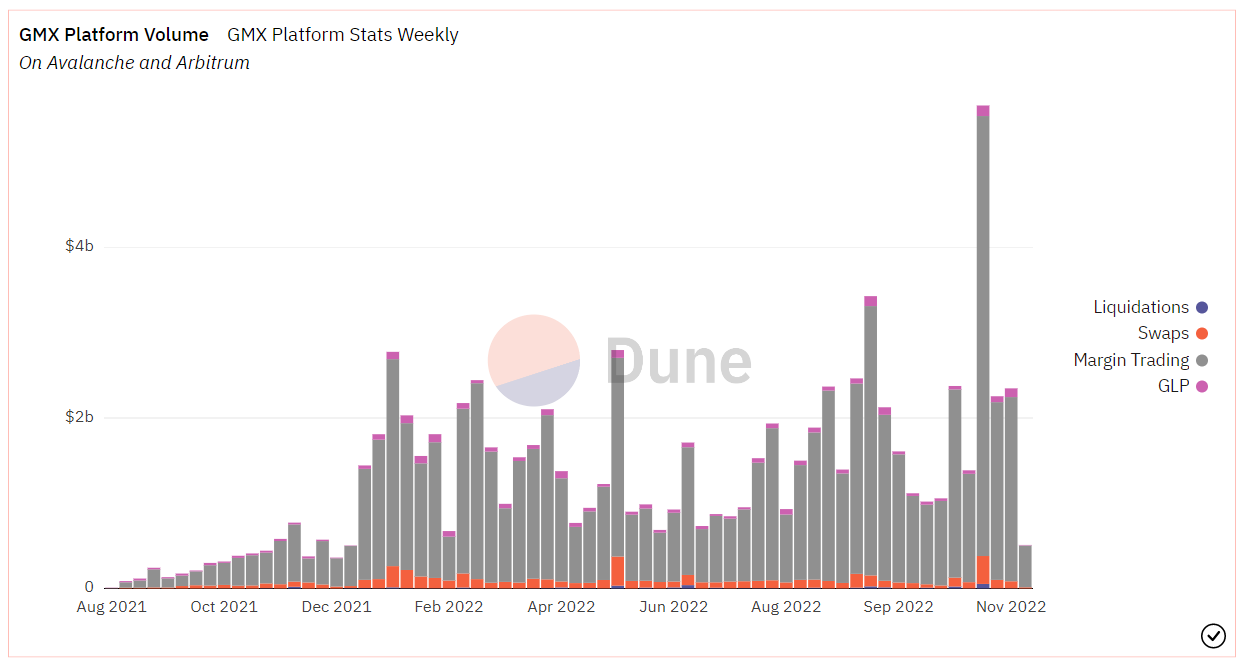

This protocol isn’t my specialty, but let’s just say a collective offering infinite liquidity for trading leads to some adverse selection.

Similar platforms have survived — i.e. Synthetix, though Perpetual Protocol and Drift both pivoted from this kind of virtual liquidity model (if only somewhat in the latter case).

A data point worth highlighting is that the number of users (and not just volume) is up. By the looks of it, GMX has the most retail margin traders in DeFi.

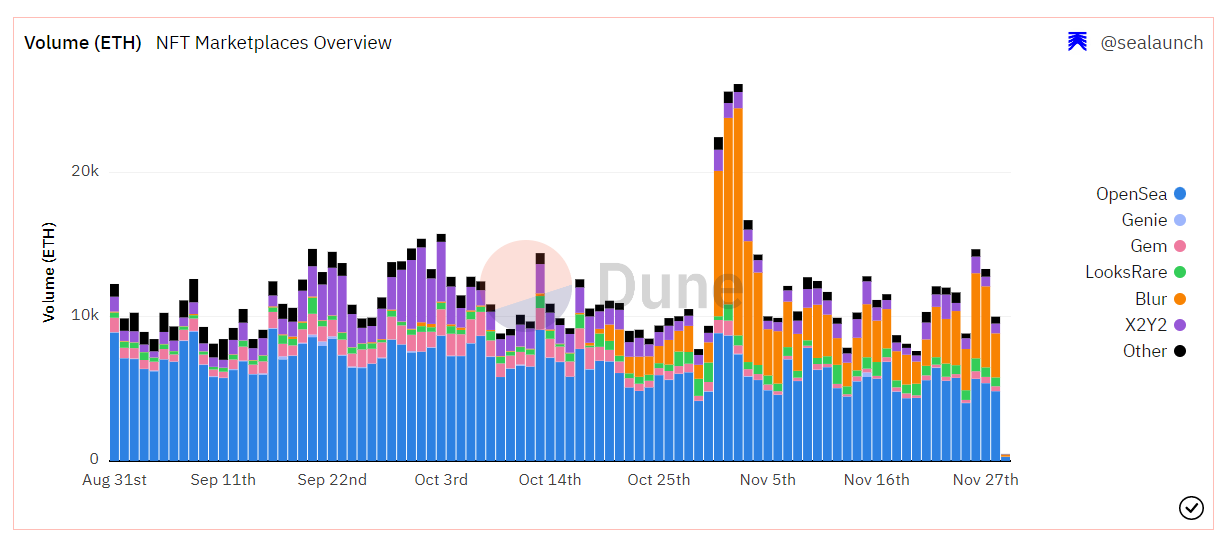

NFT marketplace volumes have stopped cratering and are now going sideways.

In the chart below, what’s most noteworthy is the increase in market share by Blur.

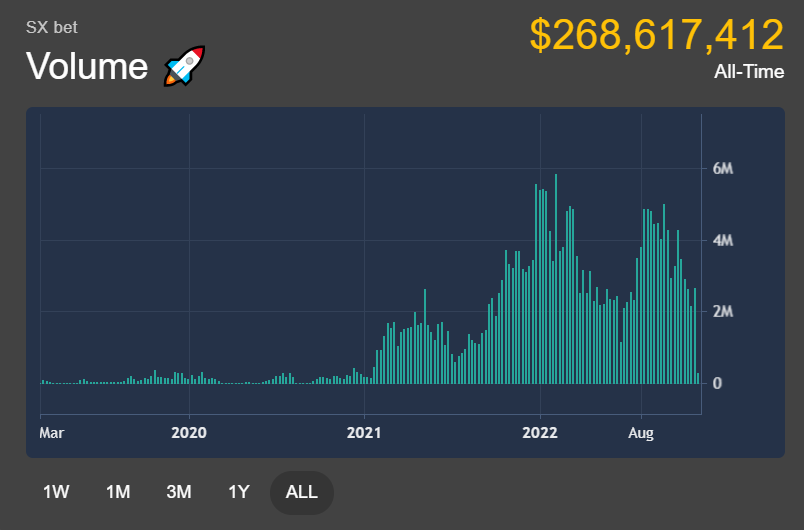

SX Network (and prediction markets)

Quietly, SX Network has built a solid business on decentralized sports betting. Just using the product, you can tell this team actually knows the market and isn’t naively applying blockchains to a problem. I’m a user.

Overall, it feels like prediction markets are finding a second wind — with Polymarket being increasingly active creating markets that relate to crypto events. The volume may not yet be there, but you can feel something positive is happening.

Good project