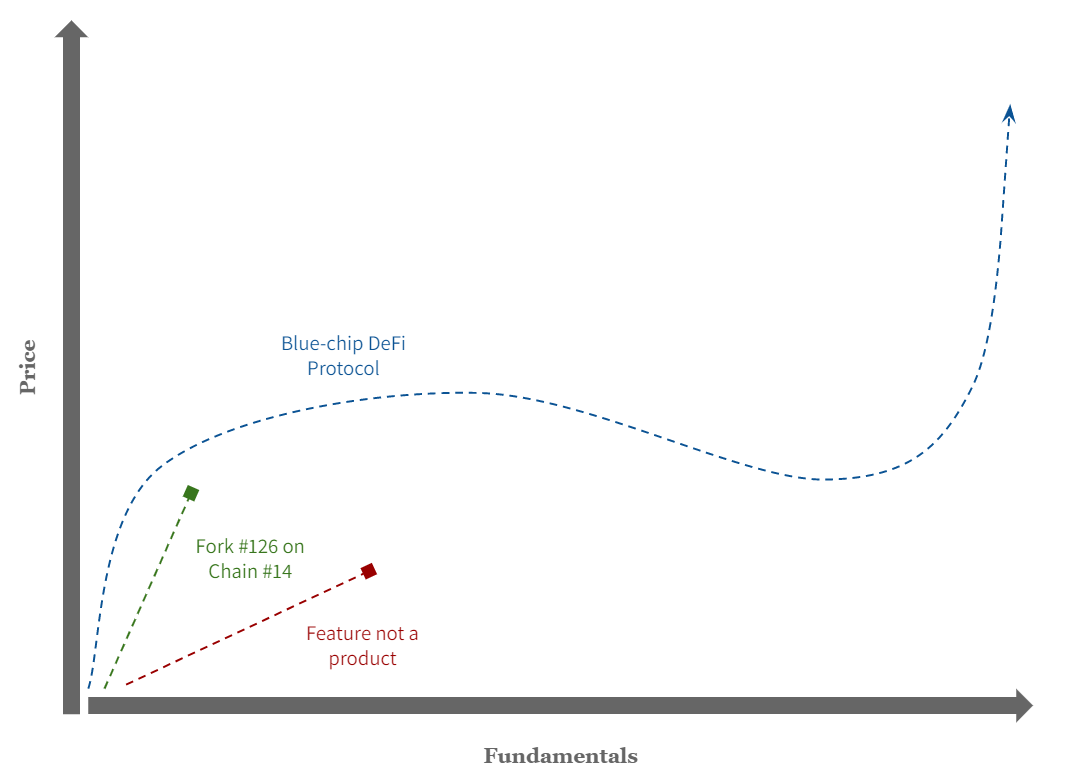

Climbing the S-curve of crypto (price) adoption

Believe it or not, one day there will be undeniable runaway winners.

A common and frustrating pattern crypto investors (in both private and public markets) deal with is a lack of creativity and an abundance of copycats. Most new projects offer minor (if any) improvements/tweaks on popular crypto protocol’s core mechanics.

Investing in these is a “relative valuation” play.

A solid DeFi primitive ported onto a new chain (or with growth-oriented token economics). Clever token economics leads to higher TVL, which leads to capturing some percentage of the market capitalization of the copied/forked project.

The original project is N years old and in dollar terms leads TVL growth in its category to grow the opportunity for the copycat. The underlying growth justifies the fork’s valuation. The more valuable the original protocol, the more copycats — and higher valuations for them — is justified.

We can now value the new x * y = k AMM #26 on EVM-chain #7.

This is not to criticize (all of) these projects or investments. It may maximize expected value for investors. A team with a slightly different approach may ultimately become dominant in the market.

It is simply the world we live in and one can become jaded by the prevalence of it. Undoubtedly, there’s often an element of short-term thinking at play.

What’s the latest narrative to latch onto and how long/far will it go? Once the relative valuation is saturated, what’s the next narrative to chase?

For practical examples, please refer to OHMforks.com. All narratives are eventually exhausted and regardless of growth in underlying metrics, prices stall.

Profitability — and moreover the perceived profitability — of this type of investing conditions market participants to behave in certain ways.

This applies to institutional investors and to retail that isn’t familiar with crypto.

It always feels like you’ve missed the boat and the best investment strategy is to go further on the risk curve. For unsophisticated retail, the historical favorite to fill this desire is XRP (and it’s incredible to the degree they miss the mark here, none of these people ever own e.g. LDO).

I’m excited about the day this type of investing isn’t the status quo anymore because it means crypto is actually getting somewhere.

Today, the top protocols have plateaued in their valuations with market participants chasing the next big thing. They have not reached the “runaway success” part of the price curve and remain underperforming investments until then.

There are no buyers for these tokens because the buyers are limited to a handful of specialized funds — for most, it is easier to buy an L1 token as an index bet, or semi-randomly fall into a false narrative of some other bullshit project being “the next big thing”.

Most large allocators in the world don’t even know how to due diligence crypto projects.

There will be an inflection point where there are clear winners in crypto. Protocols with network effects that are difficult to compete against become some of the most valuable services in the world. The obvious investment becomes betting on those key infrastructure pieces. It will become the norm for (retail and institutional) investors to buy the same assets.

This is because anyone is capable of recognizing what is genuinely popular (i.e. everyone knows Apple sells a lot of phones).

When this happens, many crypto-native investors might (for the first time) be too far on the risk curve to capture the highest profits. What has worked for them in the past doesn’t when the boring names in crypto are the biggest winners.

The inflection point is likely reached at a certain threshold of active users. ~100-200 million users was enough to kick off the dot-com bubble. Based on reports of 21 million active Metamask users at the end of 2021 and with user count doubling from summer, it doesn’t look like we’re that far from crypto’s top protocols reaching late-1990s Amazon/Google/Microsoft status in society.

When the boring projects are the best investments, it’ll conversely be the single most exciting time in crypto — because that’s when we’ll have won.