How high do we want gas fees to be on Ethereum?

High gas fees leads to sexy P/E ratio, which leads to bad user experience.

High gas fees are a double-edged sword for ETH holders:

Good: high fees mean a sexy P/E ratio, lead to more staker earnings, and put deflationary pressure on the supply.

Bad: The UX sucks as users are forced to pay triple-digit dollars for Uniswap swaps.

The goal is to avoid prohibitively expensive transactions while generating fees, and this is difficult on an L1 blockchain (like Ethereum) due to the dynamic of how quickly fees increase once block space is filled.

Before blocks are full, transactions are essentially free. Once they are filled, bidding quickly drives up the fees for everyone.

In the current market most view that demand for transactions has fallen off a cliff, as the average transaction is about 1/20th in cost from peak days. However, viewing this as a 95% drop in demand is incorrect.

Due to this dynamic where fees skyrocket easily, Ethereum doesn’t generate a meaningful amount of fees — until it does (and other L1s don’t generate anything today at all).

The sweet spot for Ethereum is probably that:

L2 proofs start to take a more significant share of the L1 fees. This would mean a move from today’s 2% of gas consumed by L2s moving to a 25-30% range.

“Legacy” apps on the L1 keep generating a high number of fees due to whale activity.

In terms of absolute transactions and user amounts, L2s quickly take over Ethereum L1.

All of this leads to a spot where even if demand spikes to levels beyond what we saw in the previous bull market, Ethereum fees would plateau at 30-40 gwei and a slightly deflationary level for the blockchain.

Anything higher and it’s likely that L2s “haven’t done their job” and competing L1s will start to see a massive increase in market share.

In the outlined dynamic, ETH stakers would receive a ~3-4% real yield.

1% from diluting non-staking ETH (this will decrease significantly over time to these levels).

1% from MEV (might be higher).

1-2% from tips.

What’s my point here?

If the ETH P/E ratio gets too attractive, this is bearish Ethereum because it means L2s haven’t got the users onboarded.

L2s should lead to consistently “reasonable” gas levels but “legacy” activity will keep ETH deflationary.

The real yield for ETH stakers "shouldn’t” go over 3-4% due to these factors for a long time. Ultimately, if this technology is successful though, demand will always outstrip block space supply.

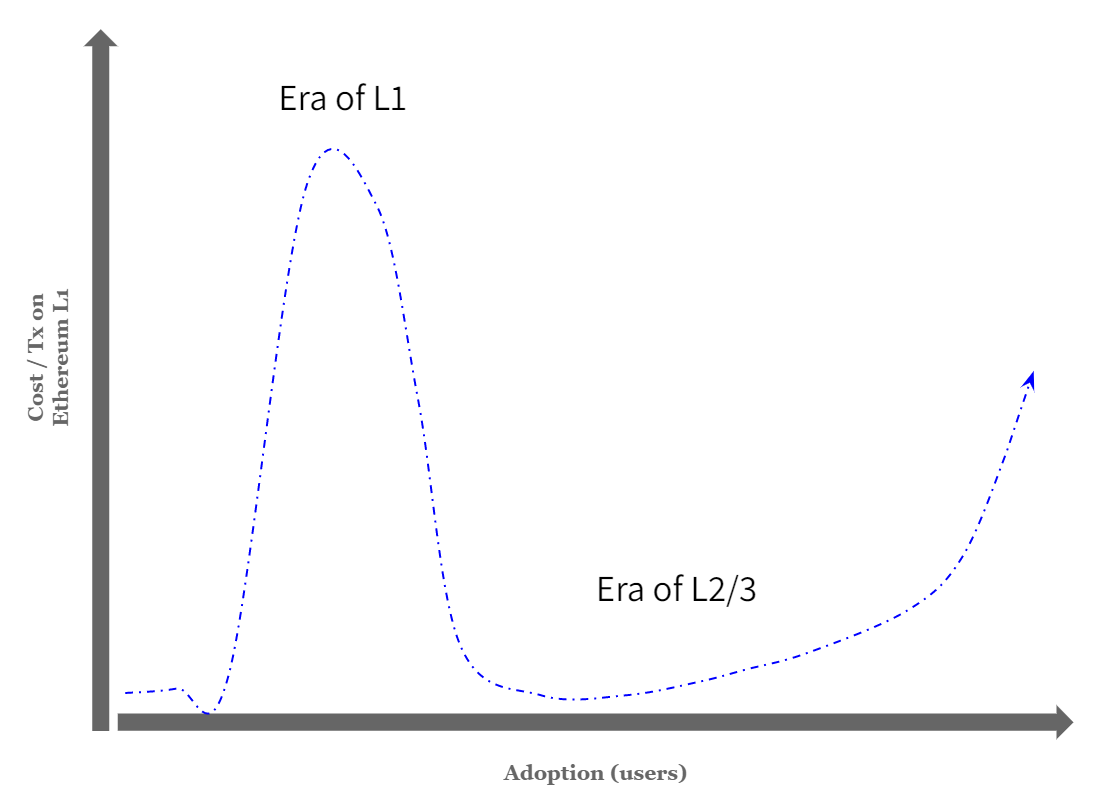

The dynamic over time ideally looks like this: