Lido's stETH could take over (Uniswap v3) trading pairs

How much in incentives would it require to flip the most popular ETH/USDC pair to stETH/USDC?

Liquid staking (and by extension LDO) is undervalued because the derivative token that includes yield is obviously better to hold than the underlying without the yield.

Users will prefer to hold stETH (or another variant) over ETH. This is why, over time, the active ETH supply in DeFi and other uses will trend towards near 100% capture by the staking derivative.

The back of the napkin valuation is something like this:

ETH’s market capitalization is $350 billion.

Lido earns 10% of the inflation reward to its holders. At the expected inflation rate, this would produce a yield of $1.5 billion annually.

With a 10% cut of those rewards, Lido’s revenue is $150 million per year.

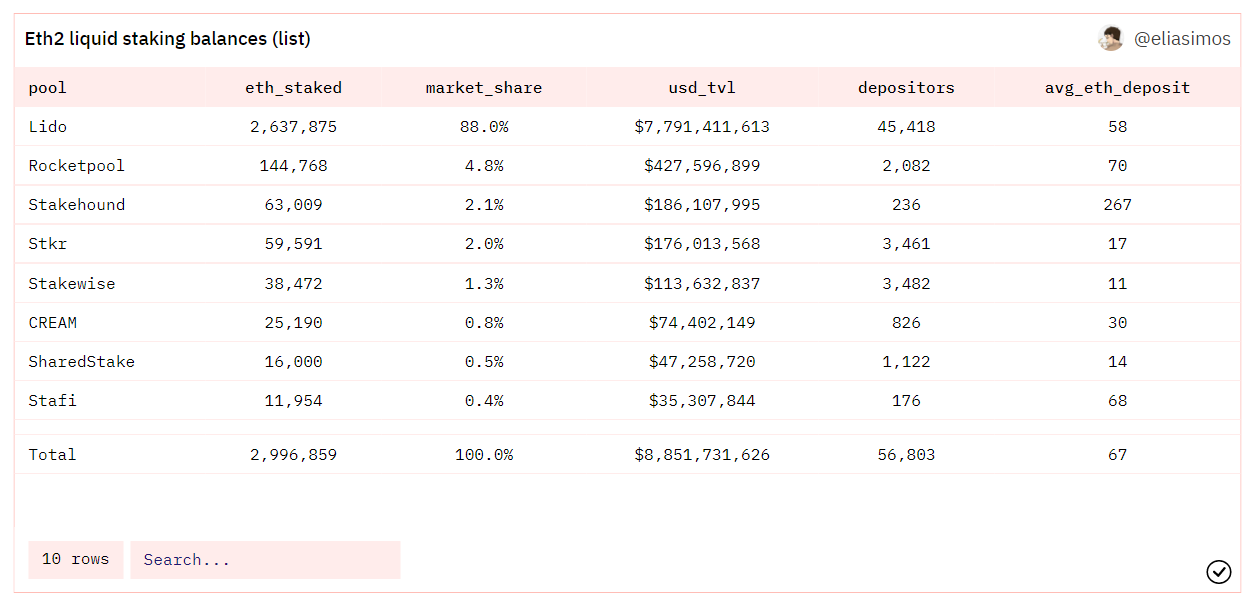

Not all validators will be controlled by Lido — maybe only 40%?

Ethereum’s inflation rate is exceptionally low compared to other chains (0.4% expected vs. 7%).

Lido needs to dominate L2s (and other L1s) to bring in more cash flows.

Other L1s and L2s tend to have higher targeted inflation rates.

The only real competitor they are currently “losing” to is Marinade Finance on Solana).

Roughly, these figures indicate profits of above $100 million per year in a baseline scenario. An easier shorthand may just be to go with 2-5% of the combined valuation of the blockchains (L1 or L2) that Lido covers.

Despite its strong market positions, stETH isn’t that useful in DeFi today compared to ETH.

There’s only 1 (slightly unattractive) supported vault type on Maker.

Aave v3 markets don’t support stETH as collateral.

No support on Compound.

Derivatives trading platforms don’t support as collateral (true for ETH as well).

Still, Lido has created a strong moat around its brand and integrations — not losing market share and growing TVL quickly.

To solidify its position as the leading staking provider, it would be interesting for Lido to explore taking over the main trading pairs on each blockchain. Typically, this starts with the native token to USDC pair.

Token trading (in addition to leverage) is the biggest use case in crypto right now. Capturing liquidity in the most important trading pairs would create a nearly unbeatable moat around Lido’s business.

The goal could be accomplished with minimal incentives:

Uniswap is not running rewards for a Lido competitor i.e. ETH pairs.

stETH already earns rewards by definition.

Good LPs on Uniswap v3 only make 10% APR (with any consistency).

Some considerations that come to mind:

Lido is not decentralized (yet) and making most of the trading volume on Ethereum go through an asset with high trust assumptions might receive push back.

Apparently, Uniswap doesn’t work well with rebase tokens. Not knowing the details, it does seem like an engineering problem and not a fundamental roadblock.

Much of the non-arbitrage trading volume is swaps from USDC to ALT with an ETH in between. stETH adding another hop. You might want to create a larger effort to replace ETH entirely.

There’s been a trend towards USDC-TOKEN trading pairs instead of ETH-TOKEN. It could be that stETH loses to a stablecoin preference.

Pushing for stETH as the dominant trading pair in Ethereum — and replicating that on other chains — would be a consequential business decision for DeFi’s development.

I don't have much to add except as an LDO holder, I’d like to see more discussion on this.

A thought on a potential governance attack on Ethereum by Lido

As an additional point, not related to stETH in DeFi but a thought that comes to mind when running Lido’s cash flow models — if Lido validators control a large portion of the staking supply, wouldn’t they vote for a higher inflation rate to boost earnings to LDO holders?

It’s not as simple as that, but mix in whatever bribes necessary to make it happen.

Might a liquid derivative staking solution make a governance attack on its base chain?