Navigating the UST crash

What it was like following the on-chain action and thinking through it moment to moment

First, I want to say that such blowups are horrible to the people who experience them. No enjoyment was taken. Crypto protocols are complex and I don’t expect people to be able to evaluate them.

Many sophisticated Luna investors understood there’s tail-risk here.

There’s a higher than 0% chance that Luna bounces back from this. My roadmap would be to fundraise and do as much as possible to collateralize UST. The goal should be to become Frax. The current model is broken.

I was following the on-chain data and situation closely for the entirety of the blow-up. This blog is about what I was looking at moment-to-moment and isn’t fully polished. I don’t have the full data and am noting what I saw.

Shoutout to 0xHamz and pedroexplore1.

In anticipation of the Curve 4pool launch with FRAX/UST/USDC/USDT, I put together this Dune Analytics dashboard to monitor its growth. As a fan of DAI and MakerDAO, I admit I was worried they’d take billions in demand and market share.

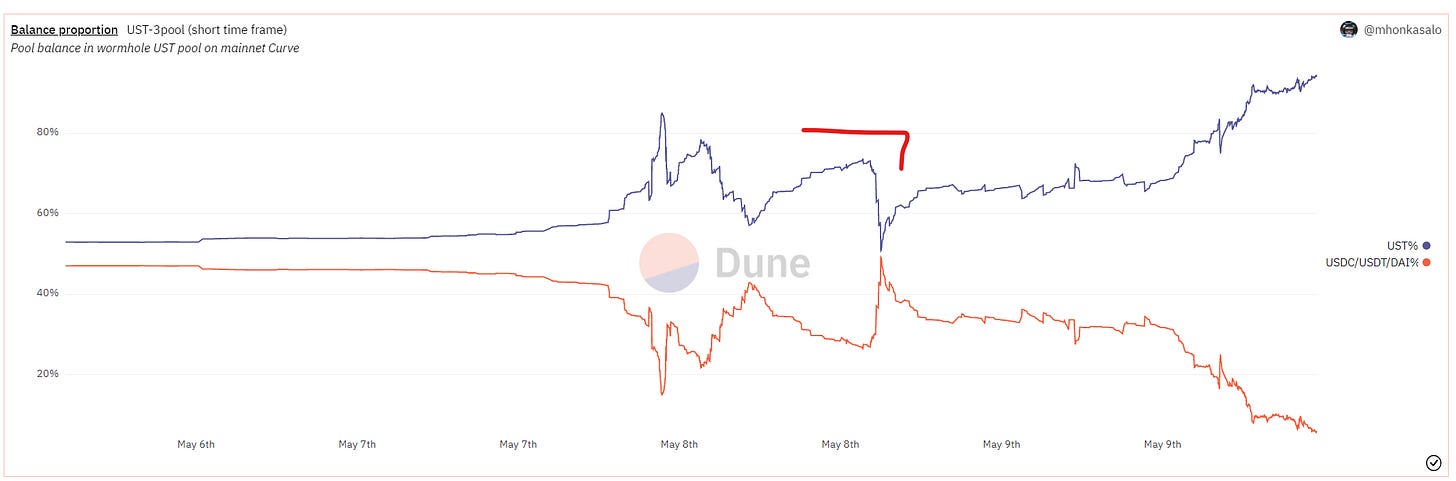

The UST-3pool was dominant at the time. Decided to add that information to the dashboard as well because why not?

At this time, there was something odd going on in the pool. An $85 million UST-to-USDC swap that had the pool slightly out of imbalance. Soon after the selling began in $300,000 to $3 million clips on Curve. Based on the on-chain data it wasn’t obvious to me it was a single party.

The defender (i.e. Hero #1) being a single party was obvious. To put the Curve pool back into balance. 50,000 or so ETH was sold and another 20,000 was sent to Binance. Keeping the UST peg was leading to hundreds of millions in on-chain ETH sales and who knows how much on Binance (the most liquid trading venue) and FTX.

The narrative at this time was that big players would keep the UST peg. No worries. It did seem a bit panicky that the address 1st dumped $51 million in stETH to ETH. This created the largest ETH/stETH price difference (and available arbitrage) since late-2021.

The first defense was successful.

Even after the first “successful” defense, the price never really recovered. This made me think there was some weakness in the move and the situation should be monitored closely.

At this time, I connected with reporter friends sounding the alarm. The “they call me Chicken Little, they call me Bubble Boy” quote from The Big Short came to mind. I was told the problem had been fixed and the peg had held.

For some reason, no one believed there could be so much sell-side liquidity to hit the market.

Quote: “look at the chart lol. do your eyes really tell you this is nothing?”.

I was still quite sure the peg would be defended. Similar to others, I did rely on the argument from authority — these people are so smart and rich that they must be playing 8D chess!

The second stage was similar to the first. Constant swaps on Curve — mostly $300k at a time and often from addresses that didn’t look “malicious” but some random NFT trader.

This is when this address (i.e. Hero #2) “fixed” the problem with a blunt $250m hammer. 2nd defense is over. Unlike the first one, this was much more rapid.

As seen from the chart above, the trendline deteriorated quickly. A prominent DeFi founder in a chat said (paraphrasing) “[firm X] must be making a killing on the arbitrage”, apparently forgetting what the word meant.

The scale started to become worrying. Hundreds of millions spent on-chain now holding UST as essentially toxic debt — and who knows how much more on centralized exchanges.

It’s not arbitrage if you don’t exit the position.

Yet on that final plateau, there wasn’t that much selling. The price calmed down for a while and I thought maybe sellers have run out of UST.

I deleted some tweets for fear of being attacked by the Luna community. If I was wrong, I’d never hear the end of it. But the price action continued to be negative — even if the on-chain wasn’t horrible for a moment.

This is when the final attack began. At this point, just on-chain there was 580 million of unsellable UST in Hero #2’s address.

It was clearly over when $0.98 was being defended to the tune of hundreds of millions on Binance. That minor tick in the middle of the red line is a swift loss of about $80 million.

Hero #2 deployed another $200m into their wallet but only spent a small portion. They knew it was over. It was obviously too little.

Now the price is at $0.83 recovering from $0.62.

If this is the result of selling over a billion from the LFG treasury to try again, I think it looks futile. The battle is lost, and all available collateral is needed to survive to another day. Binance set a floor of $0.70 which is ridiculous but OK.

It will take $350 million just to get the Curve pool back into balance.

And what if the selling doesn’t stop?

If the market is positive over the next few months Luna may yet survive this — but I struggle to see how in a down market the situation will not continue getting worse.

"The narrative at this time was that big players would keep the UST peg. No worries. It did seem a bit panicky that the address 1st dumped $51 million in stETH to ETH."

How does this keep UST's peg? What does the stETH/ETH pool have to do with the UST-3Pool one?

"It’s not arbitrage if you don’t exit the position."

Gold.