First, I don’t believe there’s any rush to heroically start buying the dip.

The underlying forces that drive crypto market cycles (in all likelihood) mean that there’s plenty of time to deploy. And given the current macro environment, there’s quite a bit of variance on how low that will be.

A few things that I think are true:

Long-time crypto investors aren’t in a rush to sell anymore. Profits were taken relatively near the highs and there’s cash waiting to deploy.

Non-native investors probably trapped themselves in buying throughout the beginning of 2022 and are sweating — they are the marginal seller left.

Existing crypto investors don’t have the dry powder to drive prices upwards into a bull market and it’s unclear when the next marginal buyer enters the market again.

The reality is no matter how excited we are about crypto, prices are set by the marginal buyer and seller coming into the ecosystem. This will follow fundamentals, but always with a lag and there’s potential for the market to under-/overshoot by quite a bit (i.e. bubbles).

What sustains crypto is building cool and useful stuff.

The crypto market cycle is a function of building → frustration with the market not reacting to it → a financial innovation triggering growth.

This was true in both the 2013-2017 and the 2018-2021 cycles.

2013-2017: There was quite a bit of underlying growth in these years. BTC transactions increased over 4 years from < 20,000 per day to > 300,000. Onboarding infrastructure to cryptos improved. Ethereum and specifically ICOs were the financial innovation that triggered the run.

2018-2021: Many of the underlying important DeFi protocols launched in 2018 (e.g. MakerDAO and Uniswap) but only a financial innovation (liquidity mining) started the run in mid-2020.

Similarly, we are likely to see a slow grind up with innovation “unlocks” — Coinbase abstracting private keys, L2s (zk-Rollups) starting to get traction, etc. — but the trigger will have to be an incentive-based one.

Below are 5 themes I’m looking at in the bear market with the caveat that I’m not in a rush to do anything.

ETH (and stETH to ETH discount)

Supply dynamics — and the requirements for how much marginal buying or selling one can tolerate — influence how adverse the market is for price appreciation to happen.

While it’s not the determining factor, there’s definitely a difference between easy mode and hard mode (i.e. Solana DeFi token dumping).

The ETH2 merge opens up “easy mode” to perhaps the highest degree in crypto ever:

Miners are less likely to sell because they don’t have to cover electricity costs (the largest force of dumping).

A lower inflation rate combined with the burn leads to negative issuance. It will actively take money going out of the ecosystem to bring the ETH price down.

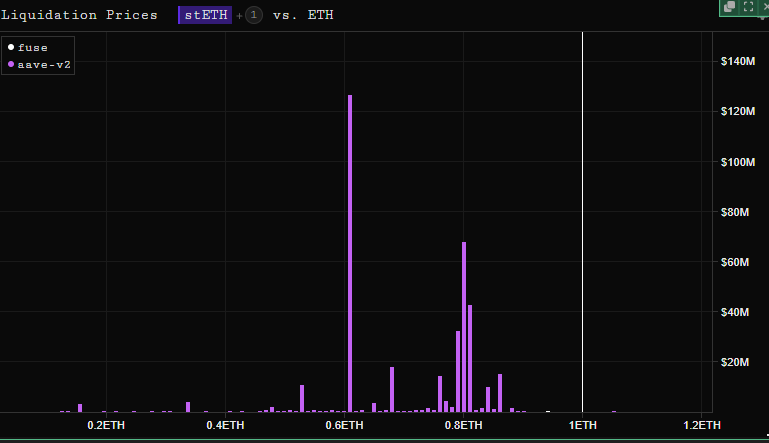

As a side note, perhaps the most crowded trade in DeFi right now is buying the stETH/ETH dip. It’s unlikely we’ll see a liquidation cascade anymore as platforms like Instadapp changed their risk profile.

DeFi the market can’t function without

DeFi has been in a continuous bear market against ETH since its initial breakout.

However, 3 positive things are true:

DeFi is still the biggest use case for crypto.

Most of the growth in the ecosystem is reflected in DeFi TVL.

If DeFi is completely useless as a category, it’s difficult to imagine what blockchains will be used for.

If something as general as an order book isn’t a useful blockchain application, we might as well pack in our bags. A full market cycle later and the largest protocols in the space (outside of L1s) are still the usual suspects — MakerDAO, Aave, and Uniswap.

With this in mind, when it’s time to deploy, there’s a category of DeFi protocols that it’s difficult to imagine the Ethereum ecosystem growing without.

I.e. Lido and Aave are good examples of protocols where if they fail, something likely would have gone so badly wrong no investment will ever do well again.

Hope the next Axie exists on the open market

A solid crypto game with token economics that boosts growth seems like the likeliest path out of the malaise and into a real new bull market. This is clearly the most likely path a 100m+ people will be onboarded to crypto.

I don’t know if the name exists in the (open) market where you could run the Axie 2.0 trade (with hopefully more longevity), but getting this one right is such a monumentally right investment that it’s worth monitoring all the options.

LooksRare (market share) vs. OpenSea

LooksRare is a name I’ve liked and the analysis has 2 factors:

Is LooksRare able to grab market share from OpenSea (and others)?

Will the NFT market hold up?

There’s reason to be positive about the first question, but the second risk has already been realized. LooksRare has done a good job in incentivizing users and building out their product, but there’s only so much to do if no one is trading NFTs.

This has the characteristics of a potential big-time win. From here, LOOKS price may be completely rekt if no one is trading NFTs but once (if) that boom starts again, it’s almost guaranteed to be a large marketplace facilitating that activity.

Monitor the metrics to find a surprise winner

I’m not sure there will be a huge surprise category that will drive Web3 adoption, but it’s worth monitoring the growth of some categories to see if there’s potential outperformance.

Directionally, this is something like:

Real-world finance (Maple etc.) shows sustainable and attractive economics (have some doubts about this).

A Web3 infrastructure winner — monitoring the Livepeer weekly transcoded minutes.

This one should be almost guaranteed to happen, but staying on the pulse of which L2 is most dominant.

DeFi 2.0 was largely a reflexive winner — leverage disguised as innovation — and that stuff will be on the table only if we reach an unhealthy part of the bull cycle again.